As I pursued Foliofficient I wanted to make sure that we were positioned for future growth by keeping a clean and tidy early-stage cap table. We had determined that we were far too early for Series A or even many pre-seed and seed investors. I'm not quite sure when is the right time for them as their web marketing sure seems to match where we were in product market fit and MVP building. That's a story for another day because who knows what need they fill if it isn't providing a high likelihood to succeed founders with early-stage capital.

What you can do is go to Friends, Family, and Colleagues who believe in your work ethic and know your ability to execute firsthand. They know that if you are running an experiment you are going to scientifically and rigorously pursue it, and additionally be a trustworthy steward of the investment you receive.

I was advised to consider an SPV (Special Purpose Vehicle) and so set off on the errand of figuring out the options to set one up and administer it.

Considerations for your SPV

What will be the initial setup cost?

What is the ongoing yearly cost, if any?

How many people can join?

What types of investments will the third-party administrator allow the SPV to invest in?

Can international (non-US-domestic) be a part of the SPV?

What are management fees to the LPs (Limited Partners aka Investors) in the SPV?

My Choice: Vauban

Through research (google-fu) I found Vauban. They had been recently acquired by Carta. I originally opened an inquiry through their web form and was declined the right to leverage working with them. One lesson I've learned is that never take no for an answer without some willingness to follow through. I realized Vauban was recently acquired by Carta and reached out to my Carta representative to inquire about SPVs. This was ultimately my way in. Vauban originally declined to work with me due to my involvement with Cryptocurrency projects, but once they realized I was working on Data Analytics this became a non-factor. If you are working with on-chain projects or any sort of token you may experience pushback. This could just be their non-willingness to manage non-traditional investments or the risk of fraud in the industry.

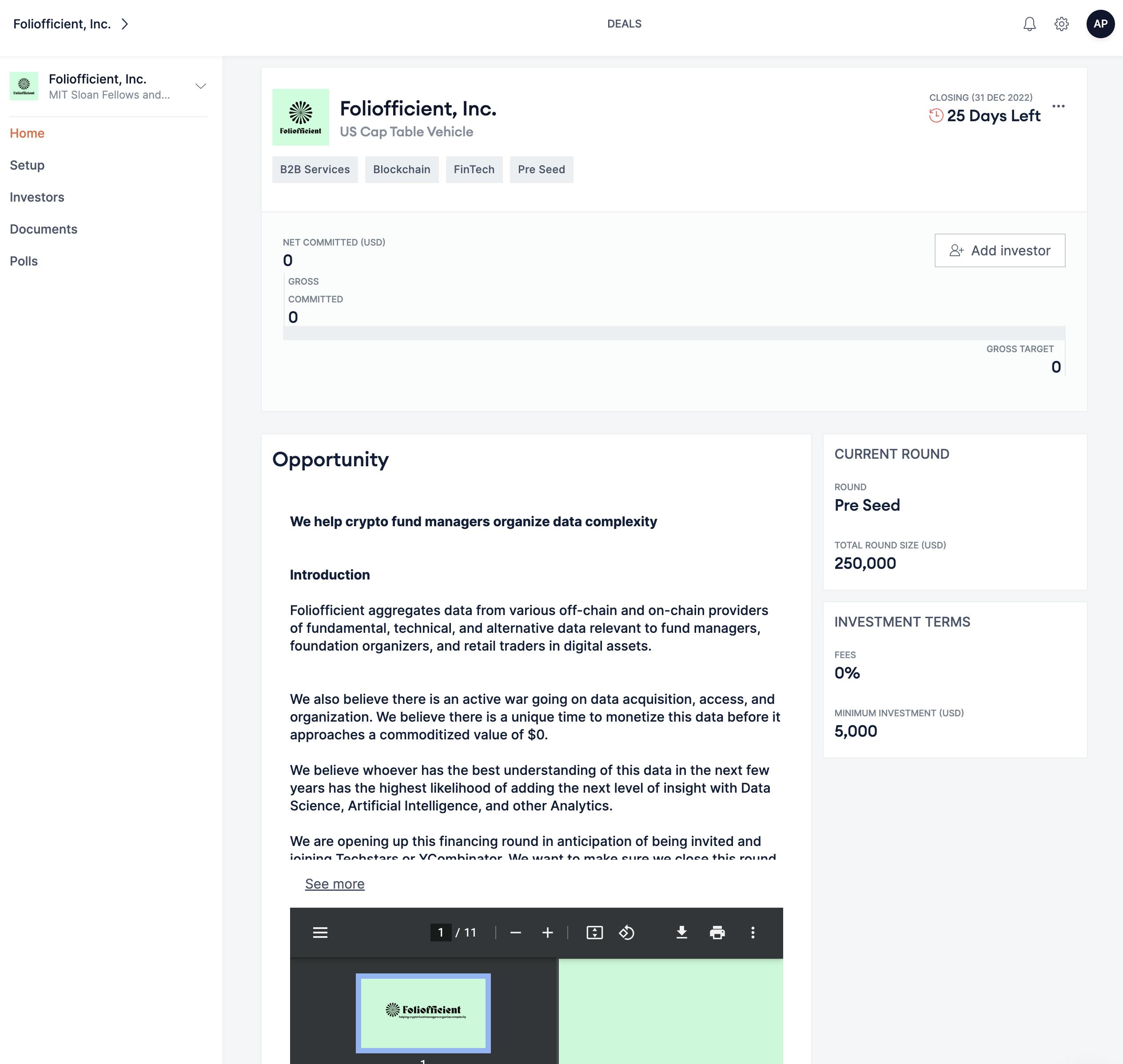

Here is a snapshot of the UI you'll get to work with. Things worth noting from above:

Setup cost is $4000

No ongoing cost - all included in the above

I believe they were willing to handle up to 100 for me, however they can handle much more.

They would not have allowed investment into Token projects, there were no other limitations as we discussed what our business was.

Internationals were allowed

They support 2%+20 fee structures, but I asked to reduce all fees as these are friends and family and I wasn't setting up the SPV to gain carry for a fund I'm operating, I was just trying to reduce friction for my investors.

The feedback from my onboarded investors (which have all been deleted from this screen for privacy) was very positive. They had a KYC (know your customer) process and some forms to fill out. It supported investments from LLCs/S-Corps as well as individuals.

The setup process and experience for me was painless:

I uploaded my Pitch Deck

I wrote an Investor Memo

I setup parameters of investment $5000 min check size and total fund size

I also noticed that this would have supported an ongoing engagement with my investors through polling and decision making.

Also a huge plus here was if I failed to hit my milestone of $250k (which I did) there would be no tear-down cost. They helped me set this up in less than 2 business days from our meeting, and they've assured me that there will be no issue tearing it all down. I would highly recommend this service.

Backup Choice: AngelList

My backup plan was to leverage AngelList, and after briefly meeting with both Vauban and AngelList, I chose not to use AngelList for the following reasons:

The cost was higher $8k setup and yearly additional costs

Upfront payment required

Fees were built in, as their SPV is geared towards VC style SPVs with Carry for the manager (GP)

I would have liked to evaluate their platform a bit more in-depth, but they didn't really engage in that way for demo purposes.

Backup to the Backup

My full backstop was to use my attorney to organize this, and likely any good attorney can do this for you. However, it won't have the tooling around it and likely will not carry the same ease of management that comes along with one of these platforms. I viewed this as the highest likelihood to succeed, but likely the highest cost to set up and administer over the life of the SPV.