Tools for Running a Fundraising Process

My journey for pre-institutional fundraising after MIT

I've been able to successfully bootstrap two services-oriented businesses but I've never successfully launched a product business that was self-sustaining and scalable with venture investment. This was a goal of mine as I pursued my MBA.

I conceptualized a business prior to entering Sloan that was named Foliofficient. We went through numerous pivots as we pursued working on this and a rotating cast of characters helped ideate each iteration. It was a definitive goal to raise outside capital to try to scale this business bigger than prior service attempts.

Through doing this I tried quite a few tools and engagement techniques. There are some things I tried that I'd probably avoid in the future, but there were a few things that worked really well that I'd start on Day 1 next go-round. This article will explain the steps that worked well and hopefully help some folks avoid the things that didn't work.

Be cautious of Easy Money

I was always skeptical of what folks deem to be easy money however while pursuing my education there were some programs available to me that are likely available to any business school student.

- Sandbox at MIT: sandbox.mit.edu

- 77.xyz: 77.xyz

- SBXI.xyz: sbxi.com

Sandbox

In my opinion of all the benefits of going to school at MIT, this was the most supportive and inclusive of all of them. Jinane Abounadi is running an amazing program out of the Innovation Headquarters and I can't speak more highly of the operation she is working on. They do all of this with a small staff and it was incredibly helpful to allow us to experiment and ideate with Marketing. Their initial contribution to us was approximately $11k through 1 year in the program. This money is not just provided up front, you have to justify each expense and work with mentors. No one ever gets the full $25k but many people ask for all of it upfront. I think the lesson they are teaching here around scrappiness is really important for many of the younger founders coming through the program. At times for me, it was frustrating to have to justify small expenses that were rounding errors for my prior businesses, but at times it's important to be humbled and forced to be creative again.

Timothy Miano helped ensure that through the summer all founders at MIT who wanted space in iHQ had space. In collaboration with Sandbox those of us who had funding were allowed to continue to use it through the summer. Timothy helped us coordinate a great initial opportunity to pursue our work under a program called Momentum largely pushed by Michael Nieset.

The support at Sandbox has been further ensured by Dan Gilbert's generous gift and an endowment to ensure this operation continues source

Thanks, all of you!

77 and SBXi

I really like the idea behind these programs and admittedly Pillar was very morally supportive of my exploration. This was very appreciated. The advertised program of 7-day decisions and funding didn't turn out to be quite true in my case. I do think this is a very useful way to engage the VC ecosystem for Boston/Cambridge founders and should be something they work towards in January through February months. This could be transformative initial capital to operate if they can get it going into the summer of their graduating year. I especially think this will be very useful for folks graduating from Sandbox engagement and not included in more selective incubator programs in the Boston ecosystem.

I was not fortunate enough to experience any other easy investment, everything seemed to require a lot of work to earn. I also started to think that the energy required to earn this input and sell your equity could be better spent on customers and billable services. I think next go around I'll invest more heavily in customer engagement and worry a lot less about investors that sap your time and energy away from value-creating activities.

Well Organized Fund Raising

First off, is the process of a well-organized fundraise. I pursued raising some startup funds from Friends, Family and Colleagues. This exercise was extremely hard to kick off for me as you have to put yourself out there in front of your prior colleagues and friends. After getting started though the outpour of support really was invigorating.

I used a few tools to pursue this process that really worked well for me.

AirTable // Investor Process Tracking

The first thing I did was brainstorm my list of accredited investors who I felt would be interested in receiving my pitch. If I thought there was a possibility you were supportive of me chasing this dream of entrepreneurship you made the list. I made it very clear in my message that I don't want to pressure people too much, and if they didn't engage I stopped sending them emails.

My process with these folks was Initial Outreach -> SMS Follow-Up -> Schedule call or move to Not Interested

At any point along the way, non-engagement moved them to Not Interested. These are folks I want to remain close to, and I don't want to be seen as trying to badger or sell them something they don't want. To all of you who replied and gave me feedback or even considered investing, it felt good. The No's were helpful to, because I could understand the why-not. These trusted friends may have given me some of the best overall feedback outright.

My Airtable had the following fields:

- Name

- Last Contact

- Tags (Angel, Pre-Seed, Seed, Series A)

- Status (Todo, Email Sent, SMS Sent, Not Interested, Soft Committed)

- Tiers (for grouping into batches of 1 through 8)

- First Name

- Last Name

- Personal Email

- Soft Commit $ Amount

- Soft Commit Projected Amount

The interesting part for me was that I just gave everyone an expected value of $5,000 per person and then that helped me understand if everyone invested how much I could raise. Then I could start to project based on engagement from running my tiered approach if I'd hit my target fundraising number given conversion rates of soft commits.

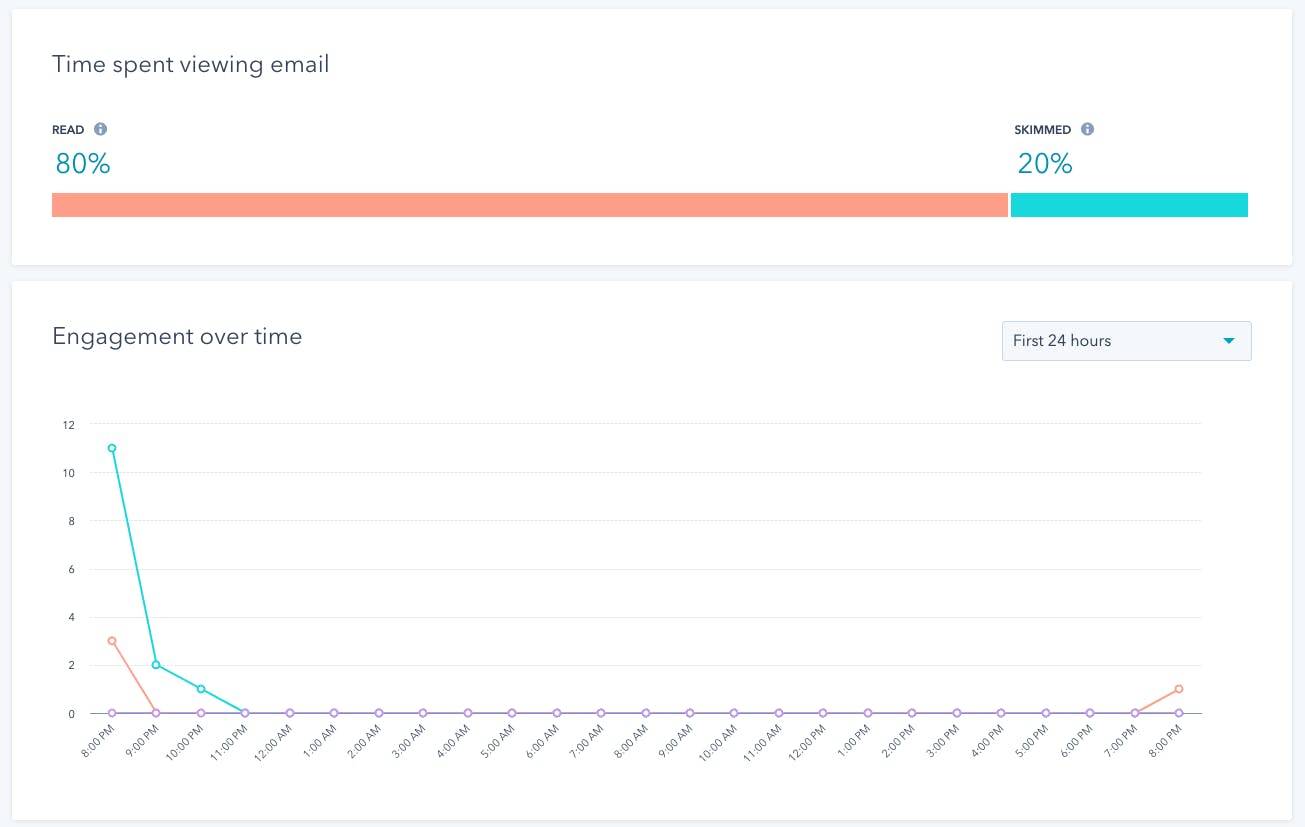

This process seemed to work really well, however, what I've now learned is that the first week or so of engagement may be your highest output for interest. That was the way it went down for me at least.

Loom // Video

Feel free to go check out the video if you want an example of what I did. There are some learnings that you may want to apply to your video that I learned through this process. I'll outline those in another article as they pertain more to the appropriate nature of the deal you should offer your early risk-takers.

loom.com/share/e409b13d28dd4f16828ac14c610c..

Hubspot // Email engagement and initial top-of-funnel

I used Hubspot's Marketing features to engage my list. I sent this video to my email tiers with the following context:

I then monitored engagement and used Calendly to schedule a follow-up. I also created 3 meetings on Thursday at 8 AM, Thursday at 8 PM, and Sunday afternoon at 4 PM to help working-class folks who want to invest join a Q&A session. I invited everyone who replied or demonstrated interest.

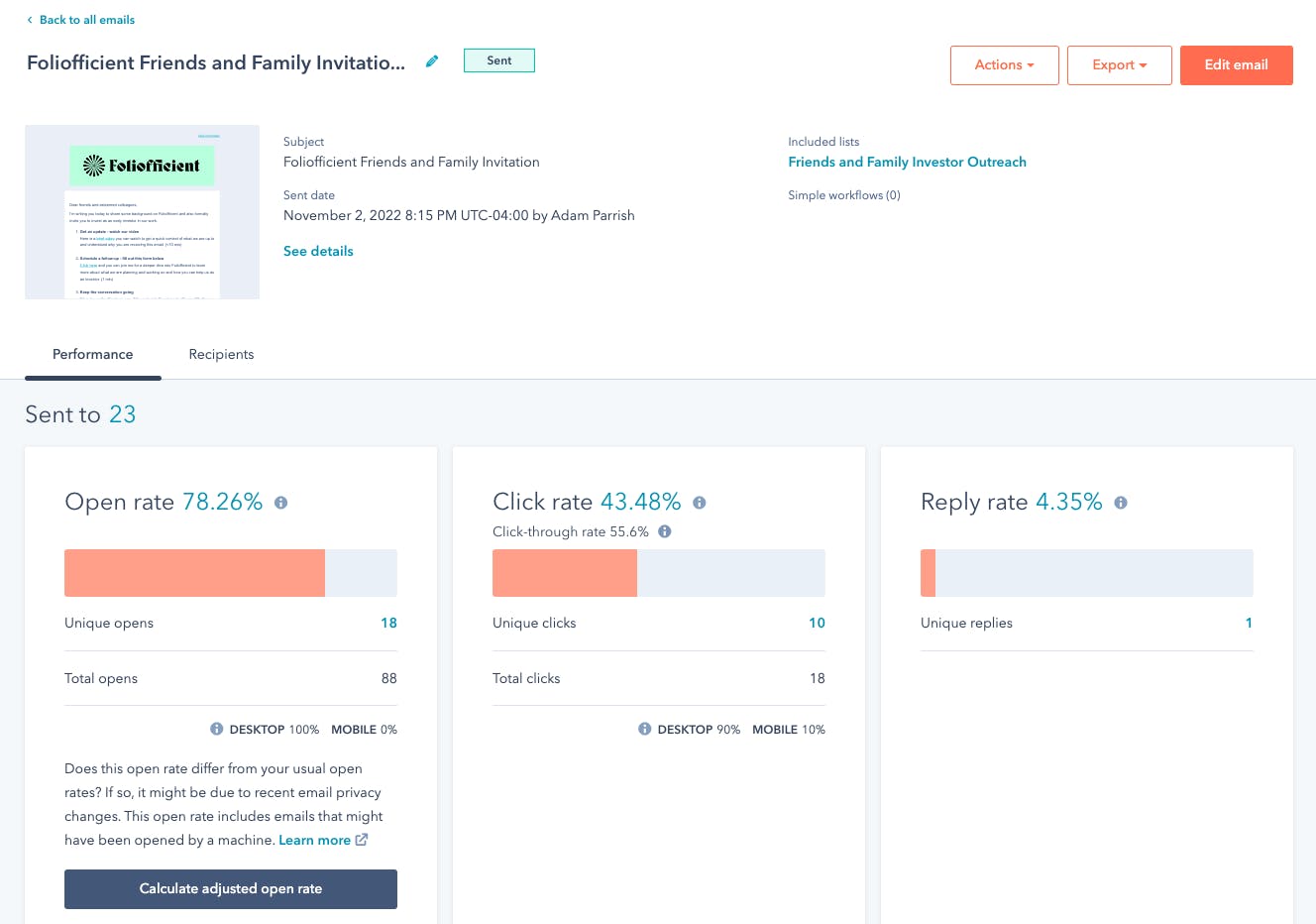

Here was the performance of my first outreach campaign. I did this eight times with different groups of people from my network.

I found these graphs to be very addictive and valuable as I pursued this little push to raise some outside interest to support the business.

This entire process was relatively low-cost to run and was using tools I was already paying for. The only major expense was the Hubspot instance, but we've been using that for Primary Market Research and Customer outreach already so it was a sunk cost at this point. That may be the biggest thing to invest in as you pursue your own process. Airtable was free, and Loom was $15 or so a month. Measuring engagement to learn what works was super useful. I hope these are helpful tricks for your fundraising with friends and family before you go pursue institutional capital if that is your path.

Learnings

- Deal Size: Make sure you value your lowest investment high enough. Next time my low-end investment will likely be $20-25k not $5k

- Deal Terms: Make sure you offer your high-risk takers (friends and family) good terms. I changed my SAFE from No Discount No Cap to 20% Discount on a $5M Cap. This will likely need to reflect your market - mine was terrible and maybe I should have had an even lower cap!

- If you want to raise $200k you probably need $1M in the expected value of outreach participants which would be a 20% conversion rate. This means in a $5k min investment you need 200 people and if you have a $20k min you need 50 people. I'd game that the conversion rate goes down as the min investment goes up, please let me know if you have data to support your expected values!

This is a great time to learn about your weaknesses, especially from your friends who have succeeded in a business where you haven't. They are aware of why you may fail at raising institutional capital and for me I had a few friends point out weaknesses in our team's commitment as a major flaw in our plan. The deal terms (no discount no cap were also common problems).

I hope you find this useful and let me know in the comments if you have questions or want clarity.