Startup Finance // Cap Table Evolution

A few rules I'll consider and a sample cap table spreadsheet

Have you been courting co-founders, engaging collaborators, and negotiating with early-stage partners? That probably means you've offered someone some equity in your future operation. Here are a few reflections I learned along the way through these conversations.

I've explained a few simple Rules I'll live by next go-round and also share a helpful spreadsheet that will allow you to compute some fast look-ahead scenarios (Pro-forma) to imagine what impact your decision will have on your equity ownership after they are implemented.

Rule 1: Save the real equity for committed founders

This is pretty simple, folks who are going to join you as some form of equal that compliments your skillset, deserve to live on the cap table with Founder's common stock. This should be extremely limited in terms of whom receives this offer. In my future endeavors, I'll likely consider trying to evaluate my colleagues (as they should be evaluating me) on the spectrum of commitment and skills alignment.

Rule 2: Pre-carve out your Options Pool

If you are going to be bringing on more hires down the road and considering some outside investment, you will be required to set aside an options pool. If you are going to have co-founders, you may as well slice this pool off at the same time as you coordinate ownership stakes with your co-founders. I set aside 15% for Foliofficient and I was advised to consider as low as 10% but of course, investors want you to set aside a higher percentage before they invest. On the high end, they may ask for 25%.

One thing that came up while talking to an investor, after admitting to having pre-carved off my 15% was that he'd like to see me increase it to 25%. I definitely found myself wondering, had I had a 0% options pool, would he have requested 25%?

Caveat: You could delay the carve-out but pencil in during your Pro-forma exercise how you'd plan to spend your options pool. Once you know who your co-founders are, and you are seeking your first outside investment, then carve out the options pool. The other option would be to delay the options pool carve-out until you know you need your first non-founder equity-compensated hire.

Rule 2.1: Pre-plan your options pool spending

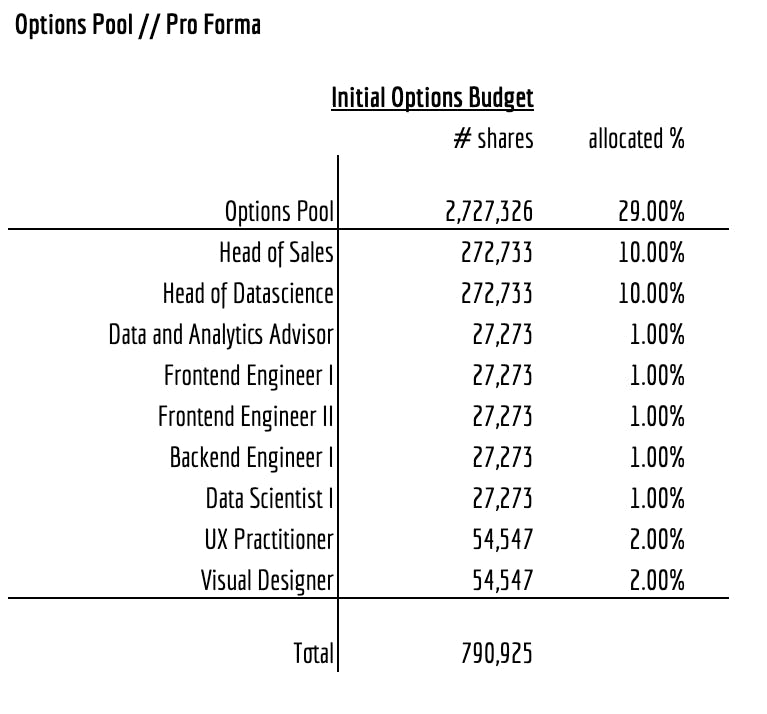

Here is an example of a pro forma options pool budget. It shows the percentage of the pool being allocated to each employee, and what would be left after each employee is hired and has exercised their options. I'd presume the "worst" case with respect to the pool that folks will exercise, meaning you may need a bigger pool later once you've spent the options.

As you can see in this case we'd have 71% allocation remaining after allocating this 29% of the options pool.

It's also worth noting, these Options convert to Common upon exercise of the option. So this budget is a "what-if" the recipient of the option exercises it. If they do NOT exercise it, the options will be unconverted. This affects all other equity holders pro-rata of their ownership. Basically, it will have a positive effect on equity holders if option-holders do not exercise. Options holders should want to exercise.

Rule 2.2: Default to giving contributors shares from the options pool

As you are meeting people who want to contribute, it is likely they are not as committed as you are. However, their contributions could be incredibly transformative to the early stages of your business explorations. I believe the right default compensation for any contributor prior to commitment is an options grant. I defaulted to discussing RSU/Common shares as a default with most Foliofficient contributors. In hindsight, I think this was wrong as it devalues the perception of the common shares to those receiving them, and it doesn't generate any more commitment from those who are exchanging collaborative efforts in exchange for equity.

Rule 3: Keep a Pro-Forma Cap Table

Finally, as you find yourself in conversations with folks about equity, have a plan. Go ahead and think through what you'd propose to them and how it affects your cap table evolution. Here is an example of a theoretical investor who wants to buy 15% of the equity in the business with an options pool of 15% and a co-founder who also has a 15% interest. This shows that post-investment you will have a 55% equity stake (which is obvious given the above) but it also shows the number of shares you'll need to have to get there.

In this example let's imagine that Founder 2 wanted to have a post-money 15% and that the Investor wants to know that you have 15% options post-money. This shows you how many shares of stock you need to sell to the investor 2,727,326 shares to allow them to own 15% after their investment is completed.

When you form your company you will declare how many shares will be issued to you, thus why this math can have potentially weird non-obvious numbers in it. If you form your initial company with your co-founders you can make the first percentages make more sense.

The sheet is again linked here if you need it and find it helpful.

Conclusion

Everyone is going to have their own method of thinking through this as they feel their way through building their startup. These are just some of my thoughts upon reflecting on how I approached it, and how I could improve in the future. Drop a comment and give me some feedback on how you'd do it, or how you think about it. Also, smash one of these emojis/reactions to show some love for the article.